When It Comes To Money, It’s Tough Being A Millennial

Many of us started graduating right around the Great Recession in 2008. We experienced firsthand that it’s hard holding on to a job (let alone finding one) when the world’s entire financial system is teetering on the brink of collapse.

The twin forces of globalization and technology have rendered many tried and true paths to the middle class obsolete. At the same time, the safety nets that your grandparents are enjoying (and we are paying for) may not be 100% funded when it’s time for us to retire (maybe they will, but I’m not counting on it). It’s no wonder that a full 80% of millennials believe they will be worse off than their parents (and in the UK this belief is reality).

And to add insult to injury, members of other generations like Martha Stewart label us lazy, entitled, and spoiled.

Look At The Facts: We Are Still Feeling The Effects Of The Great Recession

Confirming our perceptions and opinions (the pain that we feel) the data shows the precariousness of millennials’ personal finances:

Student loan stats – the average person with student loan debt has an approximate $32,500 balance. The class of 2016 is graduating with an average of $37,172 of student loan debt.

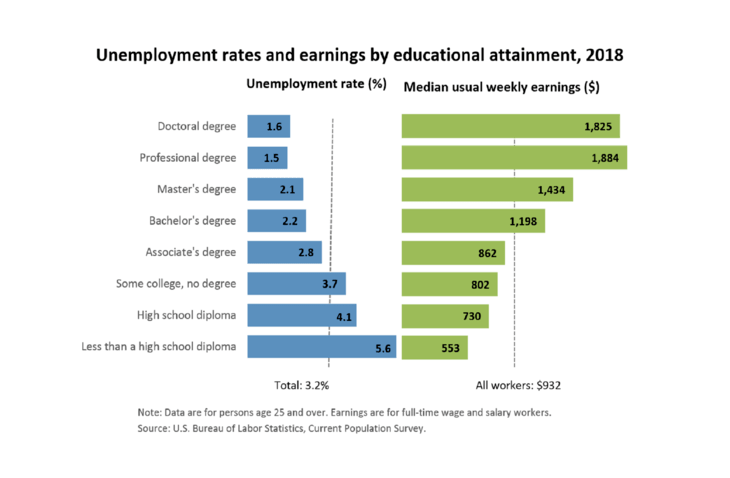

Unemployment and underemployment – the official unemployment rate for workers aged 18-29 is 8.1% while the underemployment rate for this cohort is 12.8% The latter underemployment rate, called the U-6 unemployment rate, is a more effective measure of unemployment as it accounts for discouraged workers who have left the labor force.

Wages – wages for people under 35 have dropped steadily over the last few decades and is now at $708 / week (or $36K per year).

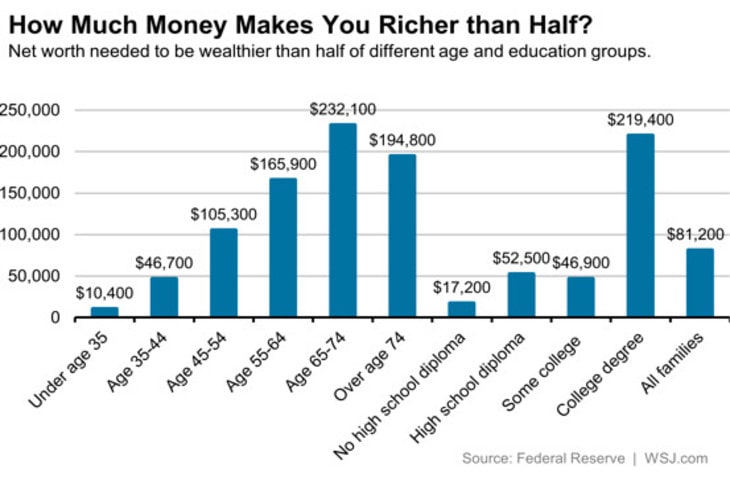

Net worth – the median millennial net worth is $10,400 while the average millennial net worth is $75,500 (the large difference in median and average net worth reflects the level of wealth inequality in the US).

Living with parents – for the first time since 1880 (more than 130 years ago), people aged 18-34 are more likely to be living at home than with a partner or spouse. In 2014, 32.1% of 18-34s were living at home vs 20% of 18-34 year olds in 1960.

Delayed marriage – 31.6% of millennials are cohabitating with a spouse / significant other vs 62% in 1960. This statistic is symptomatic of overall delayed household formation (down for people aged 20-24, slightly up for 25-34, while up huge for older populations) and reduced homeownership rates for our generation (only 35.6% of millennials own homes vs 40.6% before the Great Recession).

It’s not just Millennials who have dire financial situations: 47% of Americans would not be able to cover a $400 emergency without having to sell something or borrowing. Any surprise then that Bernie Sanders, whose socialist views represent a departure from mainstream U.S. economic policies (the status quo), enjoys a 55% approval rating from U.S. millennials?

Ok I just bombarded you with a lot of numbers – the point is yes, things are pretty bad for a lot of people; it’s not just you. You’re not alone in this. And yes, shit looks grim, but opportunity is greatest when it’s most chaotic.

Unique Opportunities For Millennials

Despite the financial hardships we are facing, we are relatively young in our careers and have several decades to recover from and adjust to the new normal. Our parents and grandparents whose fortunes have been wiped out and are relying on fixed income sources in retirement during a time of ultra-low interest rates are not as lucky.

We’re also better able to benefit from technology and a new prevailing attitude about personal finance:

- Technology platforms create opportunities for side jobs and hustles and the ability to benefit from multiple income streams. Examples include Uber, Lyft, & Airbnb (even if you don’t own a home, see if you can work with your landlord to Airbnb your rental in exchange for a share of profits).

- Those of you who are especially enterprising can create your own web-based business for relatively little cost. There’s no need to host your own servers or hire full-time developers or designers.

- Personal Finance Tools such as Mint.com give you the power to manage your money anywhere, anytime at the touch of your fingertips.

- Longer and healthier lives – young people today can expect to live to 100 (we better with all that dough we’ve shelled out on organic and natural foods).

- Living at home is no longer ostracized.

- Greater acceptance of frugality – it’s hip to be cheap.

In this article, I’m going to share with you how I have managed to leverage these opportunities and also share my fuckups on my path to financial independence. Fully digesting this article and applying its learnings will require numbers. Why? Because money is about numbers and if you haven’t developed (and aren’t willing to develop) basic numeracy skills, then you’re going to have a hard time managing your money.

More important than numbers though is your mindset. Here are a few core beliefs that I find to be important:

- You and you alone are responsible for your financial situation. You cannot blame the economy, banks, student loan companies, the government, or any other entity for your situation. Yes, we live in trying times and yes, there are entities that have likely contributed to this fuckstorm we live in, but it is 100% up to you to get yourself out of it.

- You call bullshit on the socialism and income inequality rhetoric dominating the news circuit. Wealth and personal success are worth celebrating and attainable to anyone who works hard and smart and creates value for others.

- Self-improvement is possible through education (formal and informal) and learning from the experiences of others.

- Most parents and educators are ill-equipped to pass on these values; our friends may not have developed experience with money (blind leading the blind); and mass consumer brands, the media, and banks are incentivized to keep consumers in a state of material want, leading to suboptimal life decisions.

Who am I? I’m not a scion of wealth or a tech entrepreneur who struck payday. I came from a very modest background and haven’t always been the most financially responsible person. I have, however, grown my net worth from negative God knows what to seven figures in a matter of a few short years. I did this by going against conventional wisdom and taking a disciplined and numbers-based approach to building my net worth.

That said, I have made a lot of common financial mistakes and have learned the hard way to properly managing one’s finances. Here’s a sampling of my more egregious financial mistakes:

- Bought a Mercedes that cost half of my annual income and then a few years later bought another Mercedes when I had no income while I was in grad school

- Making minimal contributions to my 401K in my 20s and not taking full advantage of the miracle of compound interest

- Had a YOLO mentality and spent way too much on rent living on the beach (those 180 degree ocean views were awesome, but cost me a pretty penny)

- Graduated with a fair amount of student debt, which I added to with two master’s degrees

- Bought an investment property with a low down payment right before the housing crash on emotion (greed and fear of missing out) and subsequently saw the value of my property decrease 40-50%

- Regularly ran up my credit card, which I paid 14%-20% interest on

- Bought $1,000 worth of gemstones in Afghanistan as part of a get rich quick scheme (the people who sold me the stones are the only ones who got rich)

- Not consistently budgeting or doing any long-term financial planning for the first 8 years of my adult life

How I Got My Financial Act Together

I used to really enjoy the finer things in life as you could tell by my list of financial mistakes. But, by adopting a more thrifty mindset and controlling my spending, I’ve been able to significantly improve my financial condition (courtesy of my wife). My wife is naturally thrifty and happens to be a good saver. However, on the downside she’s risk-averse, doesn’t invest, doesn’t budget, and doesn’t do any financial planning. I, on the other hand, am a bit of a spendthrift, I’m much more willing to take financial risks (to the point of being excessive at times), and like to think about the future and plan for it. The result of combining thriftiness (high savings rate) and taking smart financial risks is that we save over 40% of our pre-tax income; have created detailed budgets and track expenses meticulously; and have made a number of smart investments as part of our 10-year financial plan.

Saving was just the start

Saving was a necessary, but insufficient ingredient on the path to financial independence. The spark was setting a goal to buy a home by the time I graduated from my MBA program – this was a SMART goal (smart, measurable, attainable, realistic, and time-bound) not a wishy-washy goal like being rich or being able to retire. My wife and I needed to come up with a 20% downpayment in a housing market where the median price for a home exceeds $1,000,000 (for a starter home no less). I’m one of a handful graduates from my MBA class who have been able to buy a home in the San Francisco Bay Area (the nation’s most expensive real estate market). Why? Because instead of living close to campus, I decided to live with my in-laws 30 minutes from campus for cheap rent. And instead of participating in $10,000 MBA treks, I stayed on campus during breaks and worked on my startup. I graduated with a modest amount of debt (if you can call $20,000 modest) with a big enough down payment to put 20% down a new house. Most of my fellow classmates graduated with six figure debts and many continue to rent with roommates well into their lates 20s and early 30s (there’s no shame in this, though I’m sure many of them would prefer to live on their own). I mention my personal example for two reasons: 1) saving, planning, and working towards a goal can have a tremendously positive impact on your finances 2) to highlight that the people who you would expect to be most on top of their shit when it comes to money sometimes aren’t. Financial smarts aren’t taught in schools and they’re certainly not taught by the media or banks (whose advertisers want to keep you in a state of constant want / fund the things you buy to fill the void in your life, respectively).

How You Can Get Your Financial Act Together

In order to get your finances in order, you’re going to have to rely on numbers and spreadsheets. Luckily, there are lots of online tools to make this relatively easy. We’ll use financial statement analysis as part of a 3-part plan to get your finances in order: Step 1: Cash Flow, Step 2: Net Income, Step 3: Balance Statement. Businesses all around the world use these three financial statements to help them make oodles of money – shouldn’t you?

Step 1: Cash Flow

Cash flow is simply about what money comes in and what money comes out. People tend to think about cash flow on a monthly basis as many of us have monthly expenses (think about rent, mortgage, and those pesky monthly credit card and student loan bills). You have to fix your cash flow situation because running out of cash is one of the worst things that can happen to you, financially. When you run out of cash, you have to resort to undesirable financial stop gaps such as payday loans, running up your credit cards, overdrafting on your accounts, pillaging your retirement accounts, and even donating bodily fluids for money. If you’re currently in this situation, you should act with a sense of urgency, but you shouldn’t despair – some 47% of Americans cannot come up with $400 and 67% cannot come up with $1000.

Simply put: if you’re in a cash flow crunch, then you need to STOP THE BLEEDING ASAP.

Consider your current financial situation and see if these common pitfalls apply to you:

- Apartment too expensive? Move somewhere cheaper.

- Living alone? Get a roommate or two.

- Parents live close by? Then move in with them.

- Contributing to a 401K or IRA? Stop – now! This may seem like a controversial recommendation until you consider that you can’t enjoy retirement if you are rotting away in debtor’s prison.

- Blowing too much money on Kombucha and $7 pressed juices? Stop – now!

- Spending too much on gas, parking, Ubers, etc. when you can bike or take public transportation?

- Only working a 40-hour job? Get a side hustle as an Uber or Lyft driver – they are running national TV ads for drivers so you know they need people. Or pimp out your skills on fiverr, Upwork, etc.

- Student loans too crushing? Ask for a deferment or an income-based repayment schedule.

Open a Mint.com account to see where you are spending all of your money and get in the habit of logging in daily to properly characterize your transactions.

When should you consider your cash flow situation to be stable? There are two criteria:

- You are cashflow positive

- You have an emergency fund of $1,000.

Step 2: Income Statement

Assuming you are now cash flow positive and have a $1,000 emergency fund built up, you can start focusing on increasing your net income (i.e. profit) every month. Your net income is simply your income minus your expenses.

Net Income = Income – Expenses

Net income is different from net cash flows (cash in – cash out). Consider the following example:

Take-home Pay: $2,000

Rent: -$1000

Student loan principal payment: -$180

Student loan interest payment: – $20

401K Contribution: -$200

Net cash flow: $600

Take-home Pay: $2,000

Rent: -$1000

Student loan interest: -$20

401K Contribution match (from employer): +$100

Net income: $1,080

| Cash Flow | Counts in Cash Flow Calculation? | Net Income | Counts in Net Income Calculation? | |

|---|---|---|---|---|

| Take-home Pay | $2,000 | Yes | $2,000 | Yes |

| Rent | -$1,000 | Yes | -$1,000 | Yes |

| Student Loan *$200 monthly payment, $20 for interest, $180 for principal | -$200 | Yes | -$20 | Partially, only interest counts as an expense |

| 401K Contribution *$200 per month contribution with $100 match from employer | -$200 | Yes | $100 | Yes, matching contribution is considered additional income |

| Net Result | $600 | $1,080 |

*Note 401K contributions upto the annual limit as set by the IRS are typically tax deductible

I use this simple example to highlight that net cash flows and net income can be very different numbers. While cash flows are conceptually pretty easy to understand, net income can be a bit more difficult. For example, your rent of $1,000 reduces net income and cash flow by the same amount. However, your student loan payment is handled differently. The entirety of your student loan payment is a cash outflow, but only the interest you pay is considered an expense on the income statement. Furthermore, your monthly 401K contribution of $200 reduces your cash flow by $200 (since it is withheld from your paycheck), but assuming you get a 50% match, your net income increases by $100. The powerful take-away from this example is that actions that reduce your debt or increase your assets (i.e. your 401K) should not be viewed as expenses! Please note that this does not mean that going out and taking on a debt and paying it off is a good thing; if you already have debt, then it is good to pay it off.

One of the most important things you can do to improve your personal income statement is to continue to keep your expenses low, pay down your debt, and seek returns on your money commiserate with your level of risk tolerance (see example below).

How to Improve Your Personal Income Statement

Cut out non-essential expenses

Pay off high-interest, non-tax deductible debt (i.e. credit cards, personal loans)

Add an additional source of income (side hustle)

Take advantage of the full match from your employer for your 401K – this can be a 50%-100% return on your investment depending on your employer’s match.

Build an emergency fund of 3-6 months of expenses

You may have noticed that I haven’t recommended any particular order to improve your personal income statement. Some of the steps can be done simultaneously (e.g.. keeping expenses low and adding an additional source of income) while the ordering of the other steps depends on your specific situation.

Should I contribute to my 401K, pay off debt, or build an emergency fund first?

Unless you’ve taken out a payday loan with an outrageous interest rate, I recommend contributing to your 401K to get the full match 50-100% Assuming it is a regular 401K (and not a ROTH 401K), you get the benefit of a current year income tax deduction and a significant match on your contribution.

As for building up your 3-6 month emergency fund or immediately paying off high-interest non-deductible debt, the answer depends on your current financial situation. If you have a good support system (i.e. family members and friends who can help you out if you’re in a pickle) and/or you are living at home, then I would start off with paying off debt first. If you have a family to support and/or you’re not feeling confident about your current employment situation (i.e. you’re worried about getting laid off or fired), I would build up the emergency fund first.

I recommend keeping your emergency fund in an interest bearing savings account (1%). Don’t risk it in the stock market and definitely don’t bet it all on black in Vegas!

What order of debt should I pay off first?

There are two general methods to paying off debt: pay down balances with the highest interest rate first (also known as the avalanche method) or pay off loans with the lowest balance first (also known as the snowball method). For example, assume I had the following debt profile:

- Credit card with balance of $3,000 at 20% interest rate

- My undergrad student loan with balance of $5,000 at 6.55% interest rate

- Wife’s grad student loan with balance of $10,000 at 6.0% interest rate

- My grad student loan with balance of $1,000 at 5.11% interest rate

- Car loan with balance of $33,000 at 1.99% interest rate

If I use the avalanche method to paid off my debt in order of descending interest rate (i.e. highest first), I would pay off my balances in the order listed above. If I were to use the snowball method, I would pay off my grad student loan (4), my credit card (1), my undergrad student loan (2), my wife’s student loan (3), and finally my car loan (5). Even though I would likely pay more in interest with the snowball method, I would likely feel more forward momentum by paying off my small balances first, increasing the chance that I actually follow through in paying off all of my debts. I can tell you from personal experience that paying off your debts is simply exhilarating and liberating!

Are student loans all that bad?

Sure they’re tax deductible (up to a certain income level) and they were taken out to presumably increase your human capital (forget all those spring break trips you covered with loans), but I wouldn’t exactly put student loans in the good debt camp. Here’s why you need to pay them off ASAP: you can never have your student loans forgiven, even in bankruptcy or in death. Ok, this is actually a myth, but suffice to say it is *very* difficult to have your student loan debt forgiven. Furthermore, interest rates can be pretty high (especially compared to the 10 year Treasury, which is around ~2.5%) and range from 4-7%. This rate is much higher than a mortgage or auto loan since it’s an unsecured loan that isn’t backed by an underlying asset (i.e. a house or a car).

When should you consider your personal income statement to be in good shape? Here are a few criteria:

- Maxing out 401K ($18,000 per year)

- High interest debt paid off

- Saving 40% of your income – remember that your 401K contributions (including employer matches), debt principal payments, and contributions to your savings account(s) count towards your savings rate

- Emergency fund of 3-6 months built up

Step 3: Balance Sheet (Net Worth)

At this point, you’re feeling pretty secure about your financial situation. You’ve got solid income coming in (preferably from more than one source), you are living below your means and have a handle on your expenses, you’re contributing to your retirement fund, you’ve built up a healthy emergency fund, and you’ve paid off your high-interest, non-deductible debt (credit cards and personal loans). Your financial engine is chugging along, producing net income every month and you’re now ready for a total mindshift from thinking beyond the month-to-month, to building long-term wealth.

Building wealth is the ultimate goal of financial planning. While most people struggle living paycheck to paycheck (creating positive cash flow) and some are able to pay down debt and save towards retirement (creating net income), only a few take the necessary steps to truly build their wealth.

Unlike the cash flow and income statement, which represent flows, the balance sheet (i.e. your personal net worth) represents a pool. The size of this pool is determined by your Assets (things you own that have value) – Liabilities (i.e. debts)

Net worth = Assets – Liabilities

Steven Weddle · Co-Founder, Volunteer Forever

Steve Weddle is the co-founder and CEO of Volunteer Forever. Before Volunteer Forever, Steve was a Captain in the U.S. Air Force, where he served a tour of duty in Afghanistan.